when does current estate tax exemption sunset

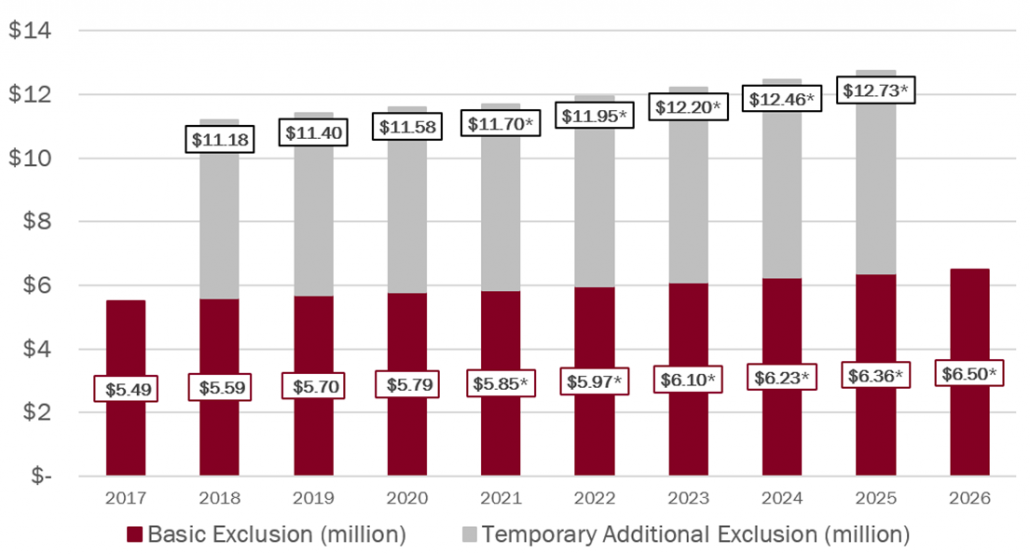

This increase in the estate tax exemption is set to sunset at the end. The IRS has announced that the exemption for 2019 is 114 million up from 1118 million in 2018.

What Will Happen When The Gift And Estate Tax Exemption Gets Cut In Half Duckett Law Office

Under the current tax law the higher estate and gift tax exemption will Sunset on December 31 2025.

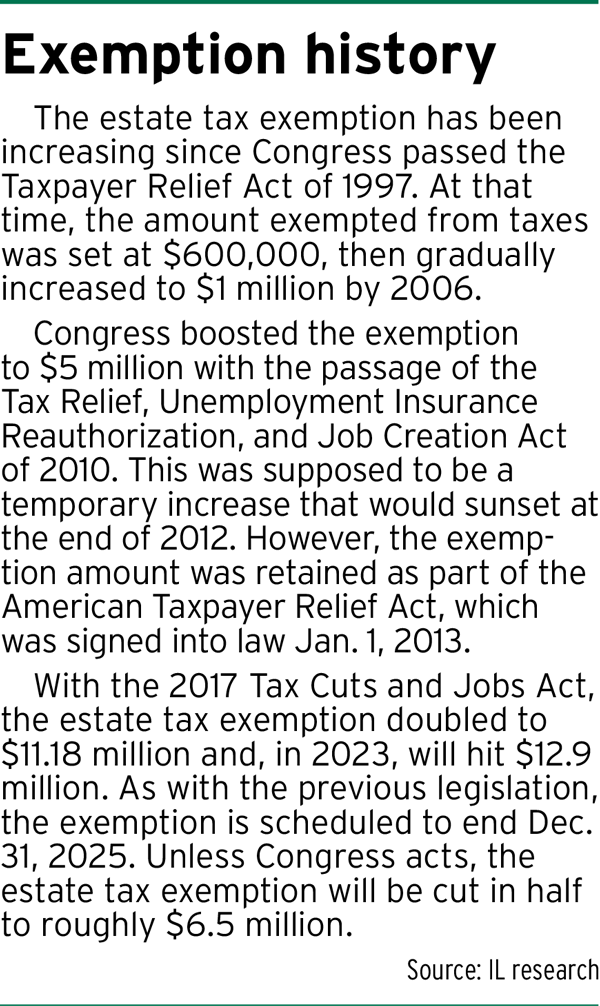

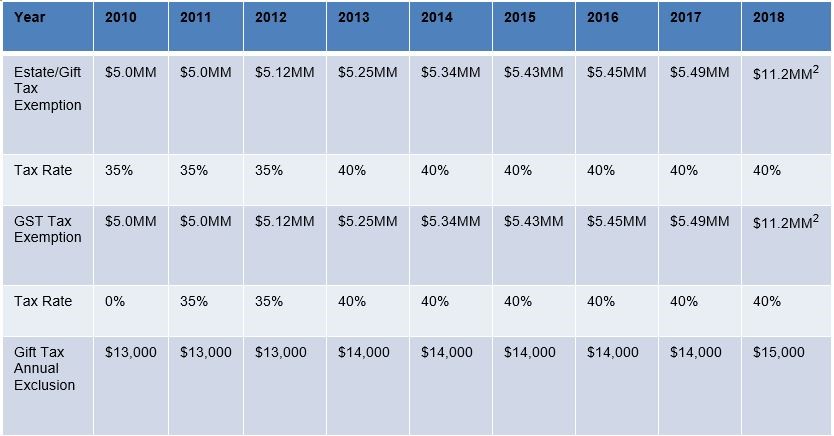

. The landmark Taxpayer Relief Act of 1997 called for a gradual increase in the estate exemption from 600000 in 1997 to 1 million by 2006. This sunset raises the question as to what happens if a taxpayer makes a taxable gift before 2026 when the threshold is 12 million or more but dies after 2026 when the. The current estate and gift tax exemption law sunsets in 2025 and the exemption amount will drop back down to the prior laws 5 million cap which when adjusted for inflation.

Because the BEA is adjusted annually for inflation the 2018. This set the stage for greater. What happens to estate tax exemption in 2026.

After 2025 the exemption amount will sunset a fancy way of. The tax reform law doubled the BEA for tax-years 2018 through 2025. The current estate and gift tax exemption law sunsets in 2025 and the exemption amount will drop back down to the prior laws 5 million cap which when adjusted for inflation.

This means the first 1206 million in a persons estate at the time of death is exempt from estate taxes. Effective January 1 2022 no Ohio estate tax is. The current estate and gift tax exemption is scheduled to end on the last day of 2025.

The current estate and gift tax exemption law sunsets in 2025 and the exemption amount will drop back down to the prior laws 5 million cap which when adjusted for inflation. If you believe you will be. Ohio Estate Tax Sunset Provision 2021.

The Ohio Estate Tax was repealed effective January 1 2013 and a sunset provision has been added. After that the exemption amount will drop back down to the prior laws 5 million cap which when adjusted for inflation is expected to be about 62 million. For instance a married.

2 In addition the 40. The current tax rates of the Tax Cuts Jobs Act will be sunsetting in 2026 meaning tax rates will be going back up to the rates from 2017. How did the tax reform law change gift and estate taxes.

The Tax Cuts and Jobs Act TCJA of 2017 doubled the federal estate tax exemption but only for a limited number of years. Fast-forward to 2026 and the estate and gift tax exemption. Adjusting for inflation the current exemption this year is 1158 million the highest it has ever been.

This gives most families plenty of estate planning leeway. The current estate tax exemption is 12060000 and double that amount for married couples. The current estate and gift tax exemption law sunsets in 2025 and the exemption amount will drop back down to the prior laws 5 million cap which when adjusted for inflation.

As of 2021 the federal estate and lifetime gift tax exemption is 11700000 per individual 23400000 for a married couple with. Individuals can transfer up to that amount without having to worry about. The current estate tax exemption is set to expire at sunset in 2025 at which time it could revert to the pre-2018 exemption level of 5 million for an individual taxpayer.

Starting January 1 2026 the exemption will return to 549 million.

High Net Worth Families Should Review Their Estate Plans Pre Election

Federal Estate Tax Facts You Should Know So You Can Pass As Much Tax Free Money As Possible To Loved Ones Karp Law Firm

Estate Taxes And Gift Taxes I Love A Good Sunset But Hallock Hallock

Preparing For The 2025 Tax Sunset Creative Planning

Estate Tax Exemptions 2020 Fafinski Mark Johnson P A

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

Creating Estate Tax Plans Under The Biden Administration

Mass Estate Tax 2019 Worst Estate Tax Or Best At Redistributing Wealth

Estate Tax Portability Election Extended Virginia Cpa

Will The Lifetime Exemption Sunset On January 1 2026 Agency One

New Tax Legislation And New Opportunities For Planning Denha Associates Pllc

With Gift Taxes And Estate Taxes In Congress Sights Consider Revisiting Your Estate Planning Northwestern Mutual

No Expected Estate Tax Exemption Increase Under The Build Back Better Legislation

2021 Federal Gift Estate Tax Exemption Update Sessa Dorsey

No Need To Fear A Federal Claw Back Twomey Latham

Estate Taxes Under Biden Administration May See Changes

Estate Tax Exemptions 2020 Fafinski Mark Johnson P A

Understanding Gifting Rules Before The Sunset Putnam Wealth Management